Post-Autumn Budget 2025 housing market recap

Table of contents

As a business, we didn’t hold out much hope of any housing sector improvements in the 2025 Autumn Budget. Now that we’ve had chance to review the Budget, we can safely say we weren’t disappointed.

But it does raise questions, and many of them. But the main one is: when will the government create the right market conditions for one of its flagship election promises: the construction of 1.5M houses over its term?

And not only that initial pledge. The OBR estimated (in March 2025) that the National Planning Policy Framework (NPPF) will build 170,000 over that target by 2029-30.

If something doesn’t change, we could have a reversal of current conditions. Here’s why I think that…

Demand vs supply

At the minute, we have demand outstripping supply. According to figures for new estate agent listings earlier this year:

“…it’s not uncommon to have 10-plus potential buyers on the first day of viewings“

But that could potentially flip if the Chancellor doesn’t address Stamp Duty. That’s because many of the new homes the government intends to build are supposedly affordable. From Labour’s election pledges regarding housing:

First dibs for first time buyers; supporting younger people the first chance at homes in new housing developments with a government-backed mortgage guarantee scheme.

Great in theory. But we’ve seen very little practical evidence of that, to date.

Incentivise first-time buyers by bringing back Stamp Duty relief

We need to incentivise first-time buyers. Labour could help no end by rolling back the last government’s Stamp Duty relief, which it terminated earlier this year. At the lower end of the pricing scale, paying no Stamp Duty would help massively.

Potential young homeowners need every bit of help saving for a deposit, not least to get a better rate. Anything they didn’t have to set aside for Stamp Duty, they could add to their deposit. It’s not rocket science.

By continuing to stifle that relief, first-time buyers are having to find even more upfront to get onto the property ladder. What’s the point of building lower-entry homes if the target market can’t afford them?

Will it get to the point that, to shift the new housing stock, the government ends up selling to landlords? That will only perpetuate and conflate the current problems we face. And talking of landlords…

Landlords: income tax on rent up 2% from 2027

The whisperings in the economic corridors of power were that landlords would have to pay NICs on rental income. That’s one thing that didn’t come to fruition that I’m actually glad about.

Instead, from April 2027, their income tax on rental property income will rise by 2%. This will increase landlords’ rates to 22%, 42%, and 47%, respectively.

So, it’s not all good news. And, bearing what we’ve said above in mind, the UK needs its landlords, too.

But it also needs to create a rental market that will allow tenants to save deposits for buying a home. It seems inevitable that landlords will pass this margin infringement on to their tenants, further cutting into their budgets.

We know many contractors top up their income/pension by letting out properties. Over the last five years, we’ve seen almost all the benefits and tax reliefs stripped back, if not away completely.

With our buy-to-let mortgage clients in mind especially, we have to hope that the government uses common sense. It won’t take much more trimming to strip profit from renting out property so much that it becomes unfeasible.

Lastly, a word about “Mansion Tax”

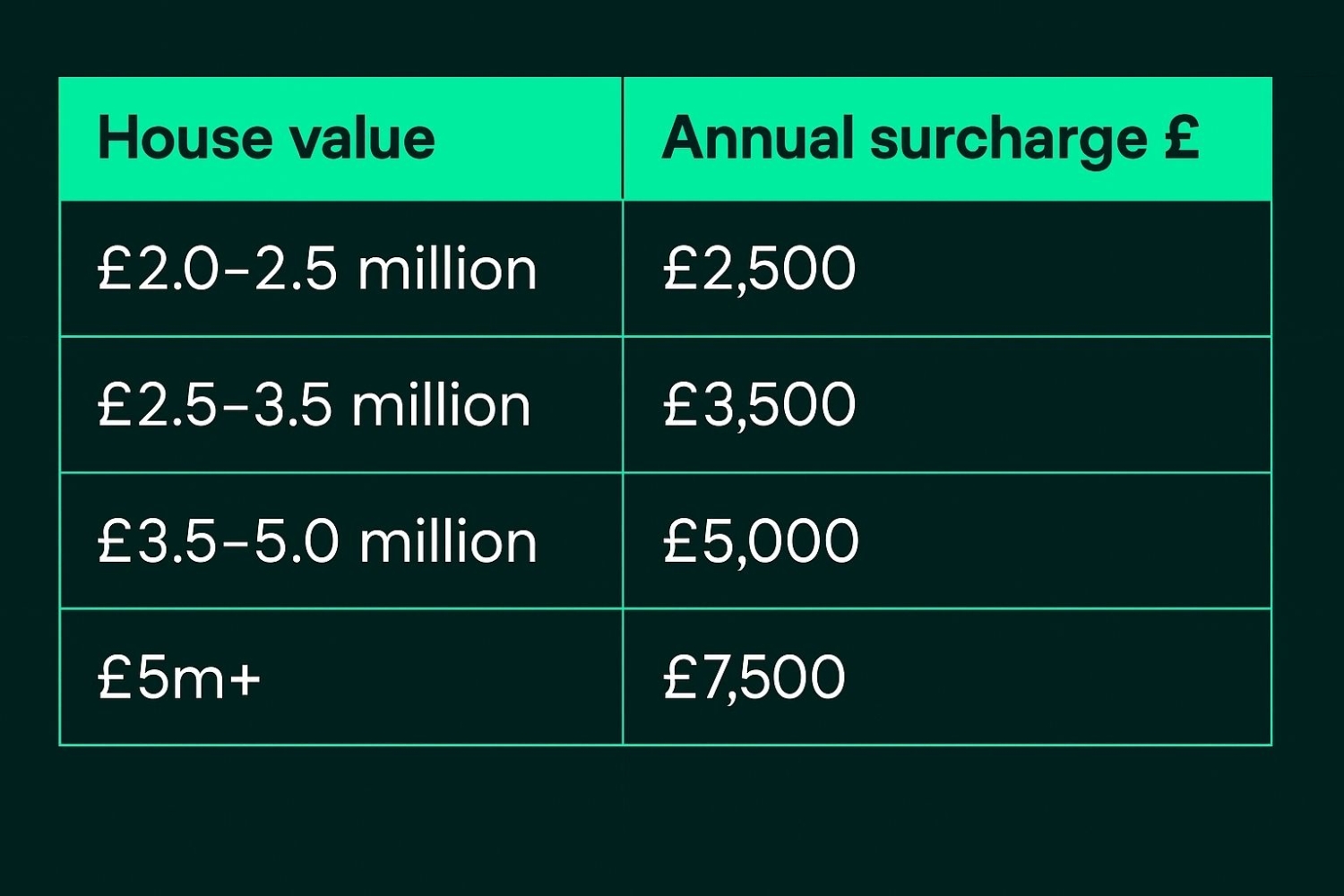

The government will introduce the “High Value Council Tax Surcharge” (Mansion Tax) in April 2028. The surcharge will affect properties valued at over £2 million.

It will be a net figure cost, not a percentage. And it stretches across four housing bands:

Naturally, this will affect homeowners in London and the South-East more than anyone. It’s almost rubbing salt into the wounds after the Stamp Duty increase in April.

Some will still say, “That’s a drop in the ocean. Anyone who can afford houses of that value can afford a few grand extra on their Council Tax.”

But again, it could affect landlords. And it’s another barrier to buying and selling homes in the current market.

A chink of light in the darkness

The only positive news in the market right now is the growing competitiveness among lenders. But this has nothing to do with the Budget.

It’s more about the margins lenders are prepared to work with. Many are slashing rates to get mortgage business on their books before the year-end.

If you’re coming to the end of your fixed term, now could be a good time to look at remortgaging. Our Rate Monitoring Service offers all the advice you need on locking in the best rate today, even if your remortgage is up six months away.

Well, that’s it for today. Look out for our further update now that the BOE’s Monetary Policy Committee has held the Base Rate at 4%. We’ll let that sink in with our contractor-friendly lenders, then see how they react as we reach the end of another turbulent year.

Share: